Issue 28: Trust is the Missing Ingredient

Welcome to Backstory, a weekly newsletter turning global technology shifts into a three-minute read. This week, we’re thinking about how simple business ethics can explain the rise of financial technology – Joseph Dana, Senior Editor

THE BIG TAKE

Trust is the Missing Ingredient

Libra was supposed to be a different kind of cryptocurrency. The idea, unveiled by Facebook earlier this year, was set to shake up the overlooked global payments sector by leveraging the social media giant’s reach and power. As soon as it was announced, however, regulators took a sceptical view. And the news keeps getting worse. Paypal, one of the Libra’s early backers, pulled out of the project last week. Others are likely to follow. What went wrong?

Trust in short supply: At the nexus of business and technology, trust remains the key ingredient for success. This is especially true for financial technology. Facebook is betting that users (and authorities) will trust it to manage a currency that could easily become one of the world’s most powerful. After all, the company already controls the majority of the world’s online chatting through WhatsApp. Bruised by years of data scandals, it seems it has miscalculated the degree to which trust in the company is waning.

Trust as a brand: Libra’s woes conceal a major opportunity. Despite Facebook’s hiccups, the remittance market is booming. With more people than ever relocating in search of work, global outflows of capital to low- and middle-income countries is hitting new highs. According to the World Bank, “annual remittance flows to low- and middle-income countries reached $529 billion in 2018, an increase of 9.6 per cent over the previous record high of $483 billion in 2017”. This is a ripe sector for disruption.

Remittances and the UAE: We’ve outlined the reasons why the UAE is ideally positioned to lead the global payments sector. With a remittance industry that’s widely trusted across emerging markets and a healthy startup ecosystem, the UAE is already disrupting the payments sector. Abu Dhabi Global Market, for example, is incubating the next great startups in the field. You can’t innovate the type of trust that’s associated with the UAE’s payments sector. It’s achieved by decades of hard work and is now the basis for a wave of startups. Watch this space closely.

QUOTE OF THE WEEK

“Think progress, not perfection.”

Ryan Holiday, Writer

OUR VIEWS THIS WEEK

Processors, processors, processors: Google made waves this monthwhen its engineers announced they had reached a milestone in quantum computing. Using a quantum computer chip named Sycamore, researchers said they performed a task in just three minutes that would take the world’s most powerful supercomputer roughly 10,000 years to complete. This is historic but we argued this week there are some pretty major caveats. The race to quantum computing might soon be like the race to 5G, and that’s not necessarily a good thing.

Latest AI developments: Keeping up with artificial intelligence (AI) news is a bit like holding a bucket under a waterfall but it’s a critical task nonetheless. From China’s value metrics on AI algorithms to Google’s deep learning advancements in the field of skin disease and a host of Apple-related health initiatives, we took the temperature of the AI values and health debate.

SPOTTED ELSEWHERE

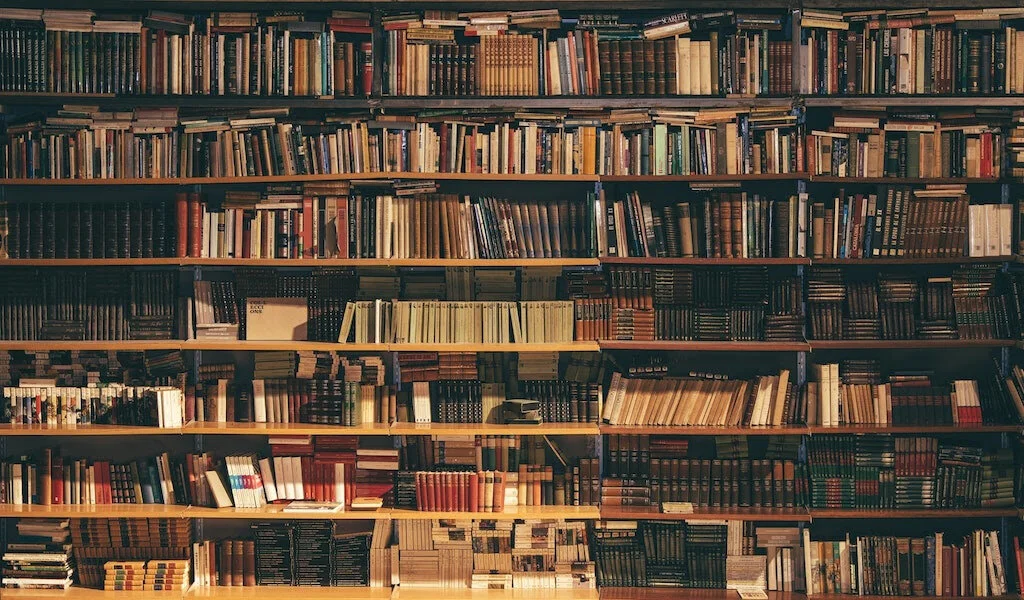

Bring back the books: If you’re a regular reader of Backstory you’ll have noticed our affinity for libraries and other physical manifestations of learning. We love technology but have a soft spot for the serendipitous experiences that define trips to libraries and bookstores. Apparently we aren’t alone. The Atlantic is reporting that university libraries in the United States are getting rid of physical books to focus on “technology” spaces. But there’s push back as students are demanding more books, not less. There’s no need to fix something that isn’t broken.

Changing the field: Despite recent gains to the contrary, Silicon Valley startups are still dominated by men. This hurts the performance of companies and, according to Bloomberg, dings the bottom line. Technology startups with at least one female founder raised 21 per cent more money than companies with only male founders. The invisible hand of the market is quietly transforming the role of gender in the workplace for the better.